Hughes v. Priderock Cap. Partners, LLC

Hughes v. Priderock Cap. Partners, LLC

2020 WL 6491003 (S.D. Fla. 2020)

September 17, 2020

Reinhart, Bruce E., United States Magistrate Judge

Summary

The court determined that filing fees, deposition transcripts, and trial transcripts were recoverable costs under 28 U.S.C. § 1920, but that extra fees for items such as shipping, exhibits, expedited copies, condensed transcripts and CD-ROMs were generally not recoverable. Additionally, costs for data loading, data hosting, project management and Relativity user fees, as well as metadata extraction, text extraction and deduplication were not recoverable. The court recommended that Plaintiff recover costs in the total amount of $5,677.89.

WEBSTER HUGHES, Plaintiff,

v.

PRIDEROCK CAPITAL PARTNERS, LLC, Defendant

v.

PRIDEROCK CAPITAL PARTNERS, LLC, Defendant

Case No. 9:18-cv-80110-Rosenberg/Reinhart

United States District Court, S.D. Florida

Signed September 17, 2020

Counsel

Christopher William Kammerer, John F. Mariani, Kammerer Mariani PLLC, West Palm Beach, FL, for Plaintiff.Mary M. Lenahan, Pro Hac Vice, William G. Miossi, Pro Hac Vice, Winston & Strawn LLP, Washington, DC, Andrew C. Nichols, Charis Lex P.C., Arlington, VA, Roy Edmund Fitzgerald, III, Mrachek Fitzgerald Rose Konopka Thomas & Weiss, P.A., West Palm Beach, FL, for Defendant.

Reinhart, Bruce E., United States Magistrate Judge

REPORT AND RECOMMENDATION ON PLAINTIFF'S MOTION FOR COSTS (ECF NO. 157)

*1 THIS CAUSE is before me upon the District Court's Referral Order. ECF No. 188. Presently before the Court is Plaintiff's Motion for Costs. ECF No. 157. On May 9, 2019, Plaintiff moved the Court for an order taxing costs against Defendant. ECF No. 157. Thereafter, Defendant objected to Plaintiff's Motion for Costs and requested the Court to exercise its discretion to either stay consideration of the Motion for Costs while Defendant's appeal was pending, deny such costs without prejudice, or significantly reduce them. ECF No. 161. On May 30, 2019, Plaintiff filed his reply to the motion. ECF No. 164. On July 3, 2019, Defendant filed its Notice of Appeal and the District Court terminated Plaintiff's Motion for Costs while the appeal was pending. ECF No. 167, 168. On April 28, 2020, the Eleventh Circuit affirmed the District Court's decisions as well as the jury verdict, and on July 2, 2020, mandate issued. See Hughes v. Priderock Capital Partners, LLC., 812 F. App'x 828 (11th Cir. 2020). Plaintiff moved to reinstate his Motion for Costs, which the District Court granted on August 12, 2020. ECF No. 188. For the reasons that follow, I RECOMMEND that Plaintiff's Motion for Costs (ECF No. 157) be GRANTED IN PART AND DENIED IN PART.

BACKGROUND

Plaintiff filed this lawsuit alleging that Defendant breached the parties’ oral contract by failing to pay Plaintiff for his services as a financial analyst specializing in mortgage-backed securities. ECF No. 186. The District Court granted Defendant's Motion for Partial Summary Judgment (ECF No. 52), dismissing Counts I and II for breach of contract and breach of a contract implied-in-fact. ECF No. 65. Defendant stipulated to liability on Count III for breach of a contract implied-in-law (ECF No. 83), and the issue of damages was tried before a jury which awarded Plaintiff $1,250,000.00. ECF No. 144. Final Judgment was entered in Plaintiff's favor on April 9, 2019. ECF No. 144. With the instant motion, Plaintiff seeks reimbursement from Defendant for his taxable costs in the amount of $51,976.20. ECF No. 157.

DISCUSSION

Under the Federal Rules, prevailing parties are entitled to recover cots as a matter of course unless otherwise directed by the court or statute. See Fed. R. Civ. P. 54(d)(1). Rule 54(d) creates a presumption in favor of awarding costs to the prevailing party. See Manor Healthcare Corp. v. Lomelo, 929 F.2d 633, 639 (11th Cir. 1991). However, this presumption is not without limits, and courts may only tax costs as authorized by statute. See EEOC v. W&O, Inc., 213 F.3d 600, 620 (11th Cir. 2000) (citing Crawford Fitting Co. v. J.T. Gibbons, Inc., 482 U.S. 437, 445 (1987)).

“Section 1920 enumerates expenses that a federal court may tax as a cost under the discretionary authority found in Rule 54(d). Crawford Fitting Co., 482 U.S. at 441-442. This section provides in part:

A judge or clerk of any court of the United States may tax as costs the following:

(1) Fees of the clerk and marshal;

(2) Fees for printed or electronically recorded transcripts necessarily obtained for use in the case;

*2 (3) Fees and disbursements for printing and witnesses;

(4) Fees for exemplification and the costs of making copies of any materials where the copies are necessarily obtained for use in the case;

(5) Docket fees under section 1923 of this title;

(6) Compensation of court appointed experts, compensation of interpreters, and salaries, fees, expenses, and costs of special interpretation services under section 1828 of this title.

28 U.S.C. § 1920.

Plaintiff seeks to recover the following as taxable costs: $400.00 for filing fees paid to the Clerk of the Court; $40.00 for the cost of serving the Complaint on Defendant; $3,950.60 for deposition transcripts of the witnesses who testified at trial; $1,452.00 for the trial transcript; $30,133.60 for document production, ESI-related expenses, and printing costs; and $16,000.00 for trial technology services.

1. Filing Fees and Process Server Fees

Section 1920(1) specifically provides that “fees of the clerk” may be taxed and it is well-settled that private process server fees may be taxed pursuant to Section 1920, provided they do not exceed the service rates charged by the U.S. Marshal's Service. U.S. E.E.O.C. v. W & O, Inc., 213 F.3d 600, 624 (11th Cir. 2000); Davis v. Sailormen, Inc., No. 6:05-cv-1497-Orl-22JGG, 2007 WL 1752465, at *2-3 (M.D. Fla. June 15, 2007) (awarding costs for service of subpoenas based on Marshal's rates). The current regulations provide that the Marshal's Service charges $65.00 per hour for each subpoena served. See 28 C.F.R. § 0.114.

Here, Plaintiff seeks to recover $400.00 in court filing fees and $40.00 paid to serve the Complaint on the Defendant. Given that the statute specifically provides for these costs, and that Defendant does not object to them (ECF No. 161), I recommend that Plaintiff's request to recover these costs be granted.

2. Deposition Transcripts

In his motion, Plaintiff initially sought to recover $3,950.60 for deposition transcripts. Defendant objected only to a duplicate charge of $639.50 as well as $70.00 for an electronic transcript and shipping/delivery costs. ECF No. 161. Plaintiff conceded that these costs should be deducted from his request. ECF No. 164.

Printed or electronically recorded transcripts necessarily obtained for use in the case may be taxed pursuant to Section 1920(2). See Bynes-Brooks v. N. Broward Hosp. Dist., 2017 WL 3237053, at 1* (S.D. Fla. July 31, 2017) (citing W&O, 213 F.3d at 620-21). However, extra fees for items such as shipping, exhibits, expedited copies, condensed transcripts and CD-ROMs are generally not recoverable. George v. Florida Dept. of Corrections, 2008 WL 2571348, *6 (S.D. Fla. May 23, 2008) (finding expedited and condensed transcripts, CD-ROMs, and expedited shipping not recoverable where claimant was unable to prove necessity, rather than mere convenience); Suarez v. Tremont Towing, Inc., 2008 WL 2955123, *3 (S.D. Fla. Aug. 1, 2008) (declining reimbursement for delivery charges or charges for exhibits).

Deducting the charges agreed upon by counsel, I find that Plaintiff's request for reimbursement of the deposition transcripts for seven trial witnesses in the amount of $3,241.10. is proper and should be granted.

3. Trial Transcripts

*3 In addition to deposition transcripts, trial transcript costs are also recoverable if they are necessarily obtained for use in the case, such as for post-trial motion practice. See Fortran Grp. Int'l, Inc. v. Tenet Hosps. Ltd., No. 8:10-CV-1602-T-TBM, 2013 WL 12203233, at *2 (M.D. Fla. Sept. 30, 2013) (court requested parties to submit post-trial briefs, thus recovery of cost for trial transcripts was proper). Here, Plaintiff seeks to recover $1,452.00 for the cost of the three-day trial transcript, which Plaintiff obtained in order to respond to Defendant's motion for a new trial. ECF No. 157. Defendant does not object to the cost. Accordingly, I recommend that Plaintiff recover $1,452.00 for the trial transcripts.

4. Document Production, ESI, and Printing Costs

Fees for exemplification and the costs of making copies of any materials where the copies are necessarily obtained for use in the case may be taxed pursuant to Section 1920. 28 U.S.C. § 1920(4). However, copies obtained only for the convenience of counsel are not recoverable. W&O, Inc., 213 F.3d 600, 623. The party moving for an award of copying costs has the burden of showing that the copies were necessarily obtained for use in the case. See Desisto Coll., Inc. v. Town of Howey-In-The-Hills, 718 F. Supp. 906, 913 (M.D. Fla. 1989), aff'd sub nom. Desisto Coll., Inc. v. Line, 914 F.2d 267 (11th Cir. 1990) (declining to award costs for copies because the defendants failed to itemize copies necessarily obtained for use in the case and those obtained for the convenience of counsel).

With regard to electronically stored information (ESI), the Eleventh Circuit has not directly analyzed whether Section 1920 authorizes costs for expenses related to electronic discovery, however, the Federal Circuit has considered the issue and allows “only limited recovery of the costs of electronic [discovery].” CBT Flint Partners, LLC v. Return Path, Inc., 737 F.3d 1320, 1325 (Fed. Cir. 2013). According to the Federal Circuit, hard-drive imaging and metadata extraction are both activities that fall in the category of “unrecoverable preparatory activities.” Id. Similarly, fees for data loading, data hosting, project management and Relativity user fees are also not recoverable. Id.

Here, Plaintiff seeks $6,328.12 in “printing costs,” for invoice entries that state: “8.5 × 11 Prints – Black & White.” ECF No. 157. Plaintiff contends that the prints were used for witness depositions, preparation of electronic trial exhibits and making multiple paper copies of Plaintiff's trial exhibits. ECF No. 164. Defendant counters that Plaintiff has not met his burden of establishing that the 8.5 × 11 black and white prints were necessary and not merely obtained for the convenience of counsel. ECF No. 161. Moreover, according to Defendant, the Court never ordered paper copies of the documents – only two copies of a thumb drive with the party's exhibits. Id. I find that Plaintiff has not met his burden of establishing that these copies were necessary and therefore, they should be denied.

Plaintiff also seeks to recover $30,133.60 for the production of documents in response to Defendant's discovery requests, including Defendant's request for the production of documents in electronic, searchable format, and for the printing and copying of documents for use at depositions, court hearing, and at trial. ECF No 157.

Defendant agrees to the following costs: $158.37 for “EDD processing to TIFF (per page),” $336.42 for “EDD processing to PDF (per page),” and $50.00 for “Electronic File Transfer.” ECF No. 161. However, Defendant objects to the remaining $23,287.69 and argues that data loading, data hosting, project management and Relativity user fees are not recoverable because they “are part of the large body of discovery obligations, mostly related to the document-review process, that Congress has not included in Section 1920(4).” ECF No. 161 at 4 (quoting CBT Flint Partners, 737 F.3d at 1331). Additionally, Defendant argues that metadata extraction, text extraction and deduplication are not recoverable because deduplication (i.e. the culling of a set of documents to eliminate duplicate copies of the same document) is not covered by Section 1920(4).

*4 Given that Plaintiff has not established that either the printing of documents produced in discovery or the use of a computerized, licensed document review platform was reasonably necessary, I recommend that Plaintiff's recovery for these items be limited to $544.79.

5. Trial Technology

Finally, Plaintiff's motion attaches an invoice for technology consultant fees, which Plaintiff incurred in preparing trial exhibits and demonstrative exhibits for use at trial and for the presentation of those exhibits at trial. ECF No. 157. Plaintiff requests $16,000.00 for costs associated with the trial technology consultant and its presentation of evidence throughout the trial. ECF No. 157. Defendant argues that courts in the Eleventh Circuit have not allowed the recovery of expenses relating to the presentation of evidence.

Section 1920(4) does not explicitly provide for trial technology fees and it is well settled that the statute should be narrowly construed. West v. Zacharzewski, 2019 WL 2567665, at 2* (S.D. Fla. May 29, 2019) (J. Maynard). Additionally, courts in this Circuit have held that expenses incurred in connection with the presentation of evidence, including trial technicians, are not taxable under Section 1920. Morrison v. Reichhold Chemicals, Inc., 97 F.3d 460 (11th Cir. 1996). Accordingly, I recommend that these costs be denied.

RECOMMENDATION

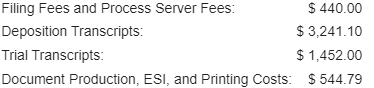

In conclusion, I RECOMMEND that Plaintiff's Motion for Costs (ECF No. 157) be GRANTED IN PART AND DENIED IN PART in that Plaintiff recover costs in the total amount of $5,677.89, as follows:

NOTICE OF RIGHT TO OBJECT

A party shall serve and file written objections, if any, to this Report and Recommendation with the Honorable Robin L. Rosenberg, United States District Court Judge for the Southern District of Florida, within fourteen (14) days of being served with a copy of this Report and Recommendation. See 28 U.S.C. § 636(b)(1) (providing that “[w]ithin fourteen days after being served with a copy, any party may serve and file written objections to such proposed findings and recommendations as provided by rules of court.”); see also Fed. R. Civ. P. 72(b) (“Within 14 days after being served with a copy of the recommended disposition, a party may serve and file specific written objections to the proposed findings and recommendations. A party may respond to another party's objections within 14 days after being served with a copy”). Failure to timely file objections shall bar the parties from attacking on appeal the factual findings contained herein. See LoConte v. Dugger, 847 F.2d 745 (11th Cir. 1988), cert. denied, 488 U.S. 958 (1988); RTC v. Hallmark Builders, Inc., 996 F.2d 1144, 1149 (11th Cir. 1993).

If counsel does not intend to file objections, counsel shall file a notice to that effect within FIVE DAYS of this report and recommendation.

DONE and SUBMITTED in Chambers at West Palm Beach in the Southern District of Florida, this 17th day of September, 2020.