SEC v. Rayat

SEC v. Rayat

2023 WL 1861498 (S.D.N.Y. 2023)

February 9, 2023

Liman, Lewis J., United States District Judge

Summary

The SEC requested access to ESI, such as emails, text messages, and other documents, to prove the defendants' involvement in the fraudulent scheme. The court granted the request and ordered the production of tax returns, financial statements, and related documents, as well as communications, from the defendants and two Canadian entities. The court also ordered the defendants to provide testimony on their financial relationships and other accounting and tax-related information.

Additional Decisions

SECURITIES AND EXCHANGE COMMISSION, Plaintiff,

v.

HARMEL S. RAYAT, et al., Defendants

v.

HARMEL S. RAYAT, et al., Defendants

21-cv-4777 (LJL)

United States District Court, S.D. New York

Filed February 09, 2023

Counsel

John J. Bowers, Matthew Scarlato, Securities and Exchange Commission, Washington, DC, for Plaintiff.Linda C. Imes, Max Clement Nicholas, Nick Reck, Rebecca Lauren Orel, Spears & Imes LLP, New York, NY, for Defendants Harmel S. Rayat, RenovaCare Inc.

Kimberly Lindsay Friedman, Silvia L. Serpe, Serpe LLC, New York, NY, for Defendant Jatinder Bhogal.

Andrew Zenner Michaelson, King & Spalding LLP, New York, NY, Alexander B. McLamb, King & Spalding LLP, Washington, DC, for Defendant Jeetenderjit Singh Sidhu.

Stephen J. Crimmins, Margaret Haggerty, Davis Wright Tremaine LLP, Washington, DC, for Defendant Sharon Fleming.

Liman, Lewis J., United States District Judge

OPINION AND ORDER

*1 Defendants RenovaCare, Inc. (“RenovaCare”) and Harmel S. Rayat (“Rayat”) (together, “Moving Defendants”) move the Court to issue a Letter of Request for International Judicial Assistance to the Supreme Court of British Columbia in Vancouver, in the Province of British Columbia, Canada (“Request”), requesting assistance to compel the oral deposition of a British Columbia resident, Mary Ellis, CPA, CA, and the production of documents from two Canadian entities, MNP LLP and Deloitte LLP (“Deloitte”).[1] Dkt. No. 178. Plaintiff, the United States Securities and Exchange Commission (“SEC”), does not oppose the Request but argues that it should be expanded to include additional documents. Dkt. No. 180.

For the following reasons, the Request is granted in part and denied in part. The Court agrees with the SEC that the Moving Defendants’ proposed limitations as to the scope of the production of tax returns and related evidence are inappropriate. The Court accordingly so-orders the SEC's proposed letter of request, a signed copy of which is attached to this Opinion and Order.

BACKGROUND

I. The Allegations

Familiarity with the prior proceedings in this case is assumed.

The amended complaint (“Complaint”) charges Rayat and RenovaCare, of which Rayat was the controlling shareholder, as well as Jatinder Bhogal (“Bhogal”), Jeetenderjit Singh Sidhu (“Sidhu”), and Sharon Fleming (“Fleming”) (collectively, “Defendants”), inter alia, with committing securities fraud in violation of Section 10(b) of the Securities Exchange Act of 1934, 15 U.S.C. § 78j(b), and Rule 10b-5, promulgated thereunder, 17 C.F.R. § 240.10b-5(a), (b), and (c). Dkt. No. 118. In broad strokes, the Complaint alleges a “pump and dump” scheme that lasted from 2007 to 2018. Id. ¶¶ 1–2. During that time, Defendants engaged in a fraudulent scheme to inflate the share price and trading volume of RenovaCare and to sell its stock at inflated prices to unsuspecting retail investors. Id. Defendants allegedly accumulated millions of shares of RenovaCare stock, distributed it among the Defendants, and then promoted RenovaCare stock to investors through a paid third-party promotional campaign that they secretly funded. Id. ¶ 2. Defendants also disseminated materially false statements about the RenovaCare in a press release and a Form 8-K filed with the SEC and engaged in manipulative trading across multiple accounts to support the share price and trading volume of RenovaCare stock while selling over one-million shares to monetize the scheme. Id.

Rayat is alleged to have been the ringleader of the scheme. But Rayat did not personally sell any shares himself, in part because he was unsuccessful in opening a trading account. Id. ¶ 62. Rather, it is the SEC's theory that he played the “long game.” Id. ¶ 3. Beginning no later than 2007, Rayat transferred shares of RenovaCare and other penny stocks to his co-Defendants Bhogal and Sidhu and others while retaining a financial interest in the shares that he transferred—either in the form of debt obligations or preferred shares in the entities that received the transferred shares, thereby permitting him to secretly profit when others sold the shares during the promotional campaign. Id.

*2 Rayat disputes that he maintained an interest in the shares transferred to Bhogal and Sidhu. He claims that the 2007 and 2008 stock transfers were intended to be a gift to them and their families “in a manner that reduced any corresponding tax burden.” Dkt. No. 180-3 at 7. He testified during the SEC's investigation that he was concerned that a gift to Bhogal and Sidhu would have been a taxable event for him and so he “went to [his] lawyers and accountants, said how do I do this without—without a tax impact, and how do I plan, you know, for my kids? How do I do this, so in the future there's limited or minimal taxes? And that's when everything was structured out, and all the detail—I just followed their leads.” Dkt. No. 180-4 at 150:10–151:9.

II. The Letter of Request

The letter of request seeks the testimony of Mary Ellis (“Ellis”), a resident of British Columbia and an accountant at the Langley, British Columbia office of MNP LLP. Dkt. No. 179-1 at 2–3. Ellis previously served as an accountant at Deloitte until a subset of Deloitte was purchased by MNP LLP in or around March 2021. Id. at 3. Ellis has served as the personal accountant to Rayat and Sidhu for approximately fifteen years. Id. According to the Moving Defendants, Ellis provided accounting advice concerning, and was involved in structuring, the 2007-era transactions and certain subsequent related-transactions between and among Rayat, Sidhu, and Bhogal. Id. at 3–4. It is the Moving Defendants’ expectation that Ellis will be able to provide testimony regarding the purpose of the transactions, including their structure, whether the transactions involved an exchange at fair market value, and whether it is possible for Rayat to profit from trading conducted by entities owned by Bhogal and Sidhu given certain Canadian tax provisions. Id. at 4. Moving Defendants expect that Deloitte, as Ellis's employer during some of the transactions, and MNP LLP, as her current employer, may possess documents related to the transactions. Id.

Deloitte has declined to make Ellis available for testimony on a voluntary basis,[2] and has stated that formal process would be necessary for it to produce documents; MNP LLP has also stated that it would not provide documents on a voluntary basis. Dkt. No. 179-2 ¶ 4(g), (h), (j). Rayat is not in possession of the 2007 and 2008 transaction documents. Dkt. No. 180-3 at 7.

III. The Dispute Between the Parties

The parties agree that the Court should issue a letter of request but differ as to its scope.

Moving Defendants argue that the Request should be limited to tax return information relating to what Moving Defendants term the “Estate Planning Transactions”—the 2007-era transactions and certain subsequent related transactions between and among Rayat, Sidhu, and Bhogal, and certain entities they owned or controlled. Dkt. No. 181 at 2. To that end, Moving Defendants argue that the return information that should be subject to the Request are “tax returns, financial statements, and related documents for [Rayat, Bhogal, and Sidhu], or any entity they owned or controlled (including but not limited to the entities enumerated [elsewhere in the Request]), for the tax years 2007 to the present reflecting the transfer of funds or assets between or among those individuals and their respective entities.” Dkt. No. 179-1 at 9-10. Moving Defendants also would limit the tax return information for various trusts related to the Defendants to that which reflects the transfer of funds or assets between or among Rayat, Bhogal, and Sidhu, or any entity they owned or controlled, and would limit the request for communications with Rayat, Bhogal, and Sidhu or persons acting on their behalf to communications “concerning any transfer of funds or other asset, a financial interest, or a financial relationship, direct or indirect, between or among any of them or any entity they owned or controlled.” Id. at 10–11. Moving Defendants would have Ellis testify about the “purpose and structure of the Estate Planning Transactions” but not on any other subjects. Id. at 7.

*3 The SEC argues that the Request should have a broader scope. In particular, it asks that the Request include (i) tax returns, financial statements, and related documents for Rayat, Bhogal, and Sidhu or any entity they directly or indirectly owned or controlled for the tax years 2007 to the present, without any additional limitations; (ii) tax returns, financial statements, and related documents for certain trusts for the same tax years again without additional limitations; and (iii) communications with Rayat, Bhogal, and Sidhu, again without any limitation. Dkt. No. 180-1 at 10–11. It asks that Deloitte and MNP LLP also be required to produce documentation related to the creation or dissolution of the trusts associated with the Moving Defendants, id. at 13, and that Ellis provide testimony not only on “the purpose and structure of the Estate Planning Transactions” but also on “defendants’ other financial relationships, and other of defendants’ accounting and tax-related information.” Id. at 8.

DISCUSSION

“Rule 28(b) of the Federal Rules of Civil Procedure and 28 U.S.C. § 1781(b)(2) authorize federal courts to issue letters rogatory that enable a U.S. litigant to obtain non-party discovery from a foreign entity.” Lantheus Med. Imaging, Inc. v. Zurich Am. Ins. Co., 841 F. Supp. 2d 769, 776 (S.D.N.Y. 2012). Rule 28(b) provides that a deposition may be taken in a foreign country pursuant to a letter of request issued “on appropriate terms after an application and notice of it” and “without a showing that taking the deposition in another manner is impracticable or inconvenient.” Fed. R. Civ. P. 28(b). Section 1781 of Title 28, which authorizes the United States Department of State to accept letters rogatory issued by foreign tribunals, allows for “the transmittal of a letter rogatory or request directly from a tribunal in the United States to the foreign or international tribunal, officer, or agency to whom it is addressed and its return in the same manner.” 28 U.S.C. § 1781(b)(2). “In considering the issuance of letters rogatory, U.S. courts apply the discovery principles contained in Rule 26.” Lantheus Med. Imaging, Inc., 841 F. Supp. 2d at 776. “The decision of whether to issue letters rogatory is within the discretion of the court.” Pearlstein v. BlackBerry Ltd., 332 F.R.D. 117, 120 (S.D.N.Y. 2019).

Both the SEC and Moving Defendants agree that the Request is properly issued to the Supreme Court of British Columbia in Vancouver, in the Province of British Columbia, Canada, to compel the attendance of Ellis for a sworn oral deposition and to compel the production of documents from Deloitte and MNP LLP. Dkt. Nos. 179-1, 180-1. Ellis served as the personal accountant for Rayat and Sidhu for approximately fifteen years and has worked at both Deloitte LLP and MNP LLP during that time. Dkt. No. 179 at 3; Dkt. No. 180-1 at 3. She was involved in structuring the 2007-era transactions and certain subsequent related transactions between and among Rayat, Sidhu, and Bhogal, through which Rayat allegedly sold millions of shares of RenovaCare, SolarWindow, and several other public U.S. companies to Bhogal and Sidhu for preferred stock in companies that the two owned and controlled. Dkt. No. 180 at 3. The disagreement is as to the scope of the Request. The SEC argues that the Request should include all tax return information for Rayat, Bhogal, and Sidhu for tax years 2007 forward as well as testimony regarding Defendants’ other financial relationships and other of Defendants’ accounting and tax-related information. Id. Moving Defendants argue that the Request and the return information produced pursuant to it should be limited to that concerning the Estate Planning Transactions. Dkt. No. 181.

The parties initially assumed, without arguing, that the applicable standard for the discovery of the tax return information at issue here is that set forth in Mangahas v. Eight Oranges Inc., 2022 WL 14106010, at *2 (S.D.N.Y. Oct. 24, 2022), and followed by numerous courts in this Circuit and elsewhere. Dkt. No. 179 at 9; Dkt. No. 180 at 2. Under that test, “[a] party seeking to compel production of tax returns in civil cases must meet a two-part showing that: ‘(1) the returns must be relevant to the subject matter of the action, and (2) a compelling need must exist because the information is not readily obtainable from a less intrusive source.’ ” Lopez v. Guzman, 2018 WL 11411132, at *3 (E.D.N.Y. Nov. 27, 2018) (quoting Sadofsky v. Fiesta Prods, LLC, 252 F.R.D. 143, 149 (E.D.N.Y. 2008)); see Mangahas, 2022 WL 14106010, at *2; Trudeau v. N.Y. State Consumer Prot. Bd., 237 F.R.D. 325, 331 (N.D.N.Y. 2006) (“Routine discovery of tax returns is not the rule but rather the exception.”).

*4 However, while this test is generally applied to requests for U.S. tax records, the tax returns at issue here will mostly, if not entirely, consist of Canadian tax returns of British Columbia residents. Dkt. No. 183 at 1. And, it is not self-evident that a U.S. court asked to compel the production of foreign tax returns should apply the same standards that it would apply to discovery requests for tax return information filed with the Internal Revenue Service (“IRS”) or with the several States.

The two-part test is rooted in provisions of the Internal Revenue Code and concerns about the public fisc of the United States and the several States—and not solely on concerns about the sensitive information contained within tax returns. “The public policy supporting the courts’ sensitive treatment of tax returns is” founded, in part, “in provisions of the Internal Revenue Code declaring that federal tax returns are confidential communications between the taxpayer and the government.” 6 Moore's Federal Practice § 26.45[1][b] (3d ed. 2021); see also S.E.C. v. Cymaticolor Corp., 106 F.R.D. 545 (S.D.N.Y. 1985) (“The decision to disclose the returns involves a balancing of the policy of liberal discovery against the policy of maintaining the confidentiality of tax returns.”). 26 U.S.C. § 6103(a) explicitly states that “[r]eturns and return information shall be confidential.” See Gates v. Wilkinson, 2005 WL 758793, at *1 (N.D.N.Y. Apr. 5, 2005) (quoting Section 6103(a) and stating “[s]ince 1977, tax returns have been described by statute as ‘confidential’ ”). In addition, when a party requests return information filed with the IRS or the taxing authority of one of the States or its subdivisions, the public fisc of the United States or the States is at issue. Courts are protective of tax return information not just because of the “the private nature of the sensitive information contained therein” but also because of “the public interest in encouraging the filing by taxpayers of complete and accurate returns.” Xiao Hong Zheng v. Perfect Team Corp., 739 F. App'x 658, 660 (2d Cir. 2018) (quoting Smith v. Bader, 83 F.R.D. 437, 438 (S.D.N.Y. 1979)). The theory is that a taxpayer will be less forthcoming with the IRS if she thought or believed that the disclosures she makes in a confidential capacity with the taxing authority might be available for a litigation adversary to see under the permissive standards of Federal Rule of Civil Procedure 26.

In other words, the two-part test is not justified alone by concerns of privacy. All kinds of document requests call for confidential and sensitive information. If the only interest at stake was that of privacy, a two-part test would not be necessary. Federal Rule of Civil Procedure 26 itself protects against overbroad requests or requests designed to “embarrass or harass.” Oppenheimer Fund, Inc. v. Sanders, 437 U.S. 340, 353 n.17 (1978). The court has authority to enter a confidentiality order if the information is particularly sensitive and its public disclosure could cause harm to the producing party. See Fed. R. Civ. P. 26(c)(1). The additional protection U.S. tax return information is accorded is based on the notion that “the fear of public disclosure may hinder the full reporting of the taxpayer's income.” Bader, 83 F.R.D. at 439.

The balance that the U.S. courts have struck, however, with respect to the production of returns filed with United States taxing authorities is not the only one that a sovereign could choose to strike. A country, or a court, concerned with protecting its fisc but also concerned with the fair and accurate determination of a matter in dispute could just as easily decide that return information should be made available to litigants without any special showing. In that event, it would not be consistent with the Federal Rules of Civil Procedure for a U.S. court to deny to a party litigating in this country the evidence it would be able to obtain through a request in the country whose public fisc is at stake. To put it in the terms at issue in this case, the United States has no interest in being more protective of information filed with the Canadian taxing authorities than the Canadian authorities themselves would have.[3]

*5 The question is therefore how Canada itself treats its own tax return information and whether it affords heightened protection to return information similar to that afforded by U.S. courts. Generally, “[w]here the alleged obstacle to production is foreign law, the burden of proving what that law is and demonstrating why it impedes production falls on the party resisting discovery.” Laydon v. Mizuho Bank, Ltd., 183 F. Supp. 3d 409, 413 (S.D.N.Y. 2016); see also United States v. Wey, 252 F. Supp. 3d 237, 252 (S.D.N.Y. 2017) (Nathan, J.). “In order to meet that burden, the party resisting discovery must provide the Court with information of sufficient particularity and specificity to allow the Court to determine whether the discovery sought is indeed prohibited by foreign law.” Alfadda v. Fenn, 149 F.R.D. 28, 34 (S.D.N.Y. 1993); see also Ecuadorian Plaintiffs v. Chevron Corp., 619 F.3d 373, 378 (5th Cir. 2010) (“In our view, however, to avoid speculative forays into legal territories unfamiliar to federal judges, parties must provide authoritative proof that a foreign tribunal would reject evidence because of a violation of an alleged foreign privilege.” (cleaned up)).

In this case, Moving Defendants have not presented persuasive evidence that Canadian tax returns are entitled to the same heightened protection applied to domestic tax returns. First, Moving Defendants argue that the same protection afforded to domestic tax returns should be afforded to Canadian tax returns because, foreign tax returns, like domestic tax returns, involve the invasion of a litigant's privacy interests. Dkt. No. 184 at 2. However, as discussed, U.S. tax returns are subject to heightened protections not just because of the “the private nature of the sensitive information contained therein” but also in order to promote the filing of open and honest tax returns. See Perfect Team Corp., 739 F. App'x at 660 (quoting Bader, 83 F.R.D. at 438). Second, Moving Defendants argue that “the Canadian Income Tax Act, like the United States Internal Revenue Code, recognizes the importance of maintaining the confidentiality of tax return information.” Dkt. No. 184 at 2. Moving Defendants cite to Section 241 of the Canadian Income Tax Act, which they state is “directly analogous” to 26 U.S.C. § 6103. Id. This argument is unavailing because Section 241 of the Canadian Income Tax Act is not directly analogous to 26 U.S.C. § 6103. While Section 241 is similar to 26 U.S.C. § 6103 in that it imposes certain restrictions on the sharing of personal taxpayer information by officials or representatives of governmental entities, Section 241 nowhere states that tax return information “shall be confidential.” And, it is that phrase in 26 U.S.C. § 6103(a) that U.S. courts have looked to in finding that domestic tax returns are subject to heightened protection. See 6 Moore's Federal Practice § 26.45[1][b]. Finally, Moving Defendants claim that Canadian law recognizes litigants’ privacy interests in their tax returns and permits redactions of tax returns. Dkt. No. 184 at 3. But, the Canadian caselaw that Moving Defendants cite does not involve an application of a test comparable to the two-part test; instead, it appears that Canadian courts allow the production of tax returns based solely on a showing of relevance (although with redactions of wholly irrelevant material). See Dkt. Nos. 184-1, 184-2 (stating that “[p]ersonal income tax returns are compellable” “to the extent that they are relevant to matters in issue”).

Regardless, the Court need not rest its decision alone on Moving Defendants’ failure to show that the return information would be protected under Canadian law, because—as an independent matter—even if the two-part test applicable to U.S. returns applies, the SEC has met it. The SEC has established that the returns are relevant to the subject matter of the action and that a compelling need exists because Moving Defendants have not identified a less intrusive source from which the information would be readily obtainable. In particular, Rayat has argued both that the transactions between him and Bhogal and Sidhu were tax-motivated estate planning transactions and that he received no consideration and enjoyed no benefits from Bhogal and Sidhu as a result of the transactions. Thus, Rayat has put the returns and his tax strategy at issue. He has also put the full nature of the relationship between him and Bhogal and Sidhu and the entities they controlled, directly and indirectly, at issue. In order to test Rayat's defense and his theory, the SEC is entitled to information about Rayat's taxes, including the tax strategies he employed over time, the avoided taxes to him from this purported strategy, and the relationship of that benefit to Rayat's total income and tax position. The SEC also is entitled to information regarding the capital gains taxes paid on the stock sales, dividends received, and other income received by each of Rayat, Bogul, and Sidhu.

*6 Moving Defendants’ proposed limitation to return information “reflecting the transfer of funds or assets between or among those individuals and their respective entities” is plainly inadequate. Dkt. No. 181 at 4. This limitation would not allow the SEC to discern whether Rayat had employed similar strategies in the past, how these transfers fit into Rayat's overarching tax strategy for a particular year, the truthfulness of Rayat's claim that he lacked any continuing interest in the stock that was transferred, or whether Rayat obtained any other form of benefit directly or indirectly as a result of those transfers. In addition, the SEC presents evidence that Sidhu, Bhogal, and Rayat have been business partners for decades, and have had numerous “intertwined business relationships.” Dkt. No. 180 at 8–9. The tax return information is thus relevant not only to understanding the transactions directly at issue, but also to understanding the “true depth of Defendants’ financial ties” during, prior to, and after the scheme. Id. at 10. Moving Defendants do not identify any other source for such information. See S.E.C. v. Garber, 990 F. Supp. 2d 462, 466 (S.D.N.Y. 2014) (holding that it is the burden of “the originator of tax returns ... to suggest alternative sources for the information they contain”); United States v. Bonanno Organized Crime Fam. of La Cosa Nostra, 119 F.R.D. 625, 627 (E.D.N.Y. 1988) (“While the party seeking discovery of the tax returns bears the burden of establishing relevance, the party resisting disclosure should bear the burden of establishing alternative sources for the information.”). Nor where the defense is that the transactions were tax-motivated is it readily apparent that such alternate sources would exist. Thus, both prongs of the test have been satisfied.

Moving Defendants argue that their Request should be deemed sufficient because their proposal includes a lengthy list of individuals and entities “that the parties are aware of having any role in the Estate Planning Transactions.” Dkt. No. 181 at 3. The Moving Defendants’ proposed form of Request would call for Deloitte LLP and MNP LLP to produce return information reflecting the transfer of funds or assets between or among Rayat, Bhogal, and Sidhu “and their respective entities.” Dkt. No. 179-1 at 12. But there is no basis to believe that Deloitte LLP and MNP LLP know all of the entities Rayat, Bhogal, and Sidhu own and control beyond those which are specifically listed. And, as noted, the SEC has presented evidence that Rayat and Bhogal are long-time family friends, who started doing business together in the 1990s, and that Sidhu worked with Rayat for over two decades in numerous businesses. Dkt. No. 180 at 7. The relationships among them are complex and extensive and the very list provided by the Moving Defendants demonstrates that the parties do business through numerous different entities. The SEC is not required to rely alone on the list of entities provided by Moving Defendants or developed during its pre-suit investigation[4]; it has offered sufficient information to demonstrate that the request for all information, regardless whether it involves one of the lengthy list of individuals and entities of which the parties are already aware, is not a fishing expedition. Rayat claims that the moment he transferred the stock he lost any continuing interest in it. The SEC is entitled to examine the returns to determine whether they establish the truth of that proposition, both with respect to the entities which are currently known to the SEC and to those which are not yet known but which the return information may reveal.

Finally, it is worth noting that, in this case, where Defendants seek to use certain tax information to bolster their defenses, “the policy of promoting full disclosure [would] not [be] thwarted.” Bader, 83 F.R.D. at 439. The presumption of Defendants’ application is that the returns—in their entirety—would actually support their defenses. That is why Defendants are seeking the returns in the first place; because they claim it would support their defenses. In that context, it would be unfair to allow Defendants to use portions of their returns to support their defenses while preventing the SEC from reviewing the broader context from which these portions arise to determine whether the inference that Defendants would have a jury draw is a fair inference. As the Second Circuit has noted in the context of privileged communications, the court must “protect[ ] the party, the factfinder, and the judicial process from selectively disclosed and potentially misleading evidence.” In re von Bulow, 828 F.2d 94, 102 (2d Cir. 1987); see BristolMyers Squibb Co. v. Rhone-Poulenc Rorer, Inc., 1997 WL 801454, at *1 (S.D.N.Y. Dec. 31, 1997) (“Based principally on notions of fairness, courts have imposed ... a ‘subject matter waiver’ ... when [a] privilege-holder has attempted to use the privilege as both ‘a sword’ and ‘a shield’ or when the party attacking the privilege would be prejudiced at trial.” (citation omitted)). “[T]he traditional concern with the privacy of these returns” is also easily satisfied by “a confidentiality stipulation which prohibits the disclosure of any tax returns produced to anyone other than counsel.” Bader, 83 F.R.D. at 439. If it turns out that the additional information requested by the SEC but resisted by Defendants is truly irrelevant, Defendants will not have been harmed. On the other hand, should it be that the information that the Defendants resist disclosing is not irrelevant but would put the lie to the Defendants’ claim, it would not only be the SEC but the truth-finding function itself that would be harmed.

CONCLUSION

*7 The Request is GRANTED IN PART and DENIED IN PART. A signed copy of the SEC's request for international judicial assistance is attached to this Opinion and Order.

The Clerk of Court is respectfully directed to close Dkt. No. 178.

SO ORDERED.

UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK

SECURITIES AND EXCHANGE COMMISSION, Plaintiff,

- against -

HARMEL S. RAYAT, RENOVACARE, INC., JATINDER BHOGAL, JEETENDERJIT SIDHU, and SHARON FLEMING, Defendants,

- and –

TREADSTONE FINANCIAL GROUP LTD., TREADSTONE FINANCIAL GROUP LLC, BLACKBRIAR ASSET MANAGEMENT LTD., and 1420527 ALBERTA LTD., Relief Defendants.

Case No. 1:21-cv-04777-LJL

REQUEST FOR INTERNATIONAL JUDICIAL ASSISTANCE

The United States District Court for the Southern District of New York presents its compliments to the Supreme Court of British Columbia in Vancouver, in the Province of British Columbia, Canada, and requests judicial assistance to compel the attendance of one witness, Mary Ellis, at a sworn oral deposition and to compel the production of documents from two corporate witnesses, Deloitte LLP and MNP LLP, to be used in a civil proceeding before this Court in the above-captioned matter. This Court requests the assistance described herein as necessary in the interests of justice.

I. Summary Of Action

The Securities and Exchange Commission (“Commission”) brought this public enforcement action on May 28, 2021, in the United States District Court for the Southern District of New York against Defendants Harmel S. Rayat and RenovaCare Inc. (“RenovaCare”). See Complaint, attached hereto as Exhibit (“Ex.”) A. RenovaCare is a publicly traded company in the United States, and Mr. Rayat is its controlling shareholder. See id. ¶¶ 9-10.

The Commission alleges that Mr. Rayat and RenovaCare violated the securities laws by misrepresenting in a press release their involvement in a public promotion of RenovaCare by a third-party online financial publishing company called StreetAuthority LLC (“StreetAuthority”). Id. ¶ 1. The Commission alleges that Mr. Rayat made these alleged misrepresentations so that he and his associates could profit from an artificially increased RenovaCare stock price. Id. ¶¶ 76-80. Mr. Rayat and RenovaCare denied these allegations in their Answer on August 31, 2021. Among other defenses, Mr. Rayat claims that he did not sell a single RenovaCare share while the StreetAuthority campaign was active, or at any point in the last decade.

On August 30, 2022, the SEC filed an amended complaint. See Amended Compl., attached hereto as Ex. B. The Amended Complaint alleges that Mr. Rayat profited from the StreetAuthority campaign indirectly through sales by entities owned by new defendants Jeetenderjit Sidhu and Jatinder Bhogal. Id. ¶ 3. Specifically, the Commission now alleges that Mr. Rayat and his “associates,” played a “long game” under which Mr. Rayat transferred to entities controlled by Mr. Sidhu and Mr. Bhogal shares of a predecessor company to RenovaCare and several other companies in exchange for preferred shares in Mr. Sidhu and Mr. Bhogal's entities (the “Estate Planning Transactions”). See Am. Compl. ¶ 3. The Commission alleges that these preferred shares “allowed Rayat to profit from the sale of shares by others during the promotional activity.” Id. There were numerous entities and individuals involved in the Estate Planning Transactions, the Defendants’ sale of RenovaCare and other stock involved in these transactions, and the fraudulent scheme alleged in the Amended Complaint, including Kalen Capital Corporation, Kalen Capital Holdings LLC, 1420524 Alberta Ltd., 1420525 Alberta Ltd., 1420468 Alberta Ltd., 1422688 Alberta Ltd, Fargo West Investments Ltd., Collingwood Holdings LLC, Blackbriar Asset Management Ltd., Blackbriar Asset Management LLC, Treadstone Financial Group Ltd., Treadstone Financial Group LLC, the DS Sidhu Trust, the PK Sidhu Trust, Gurmeet Sidhu, Jasvir S. Kheleh, Amarjit Kaur Sidhu, Anchhattar Singh Sidhu, Manjit Kaur Sidhu, Priya Kaur Sidhu, Jasvir K. Sidhu, Dayan Singh Sidhu, 1420527 Alberta Ltd., 1420527 Alberta LLC, Boston Financial Group, Ltd., Boston Financial Group LLC, Wolverhampton Holdings LLC, Vector Asset Management Inc., Heritage Family Trust, the Legacy Family Trust, Amritpal Tanda, Arian Soheili, Nirmal Singh Bhogal, Gurdyal Kaur Bhogal, Kesar Dhaliwal, Indy Panchi, Mehar Bhogal, Mehtab Bhogal, and Ranjit K. Bhogal. See Am. Compl. ¶¶ 25-32, 37-48, 196-98; Exs. 1-6

*8 The individual identified in this request, Mary Ellis, is a resident of Surrey, British Columbia, and works as an accountant at the Langley, British Colombia office of MNP LLP. Previously, Ms. Ellis served as an accountant at Deloitte LLP, until a subset of Deloitte LLP was purchased by MNP LLP in or around March 2021. Ms. Ellis's testimony is highly relevant to the parties’ claims and defenses. Ms. Ellis's current employer, MNP LLP, and former employer, Deloitte LLP, have evidence in their possession, custody, or control that is highly relevant to the parties’ claims and defenses.

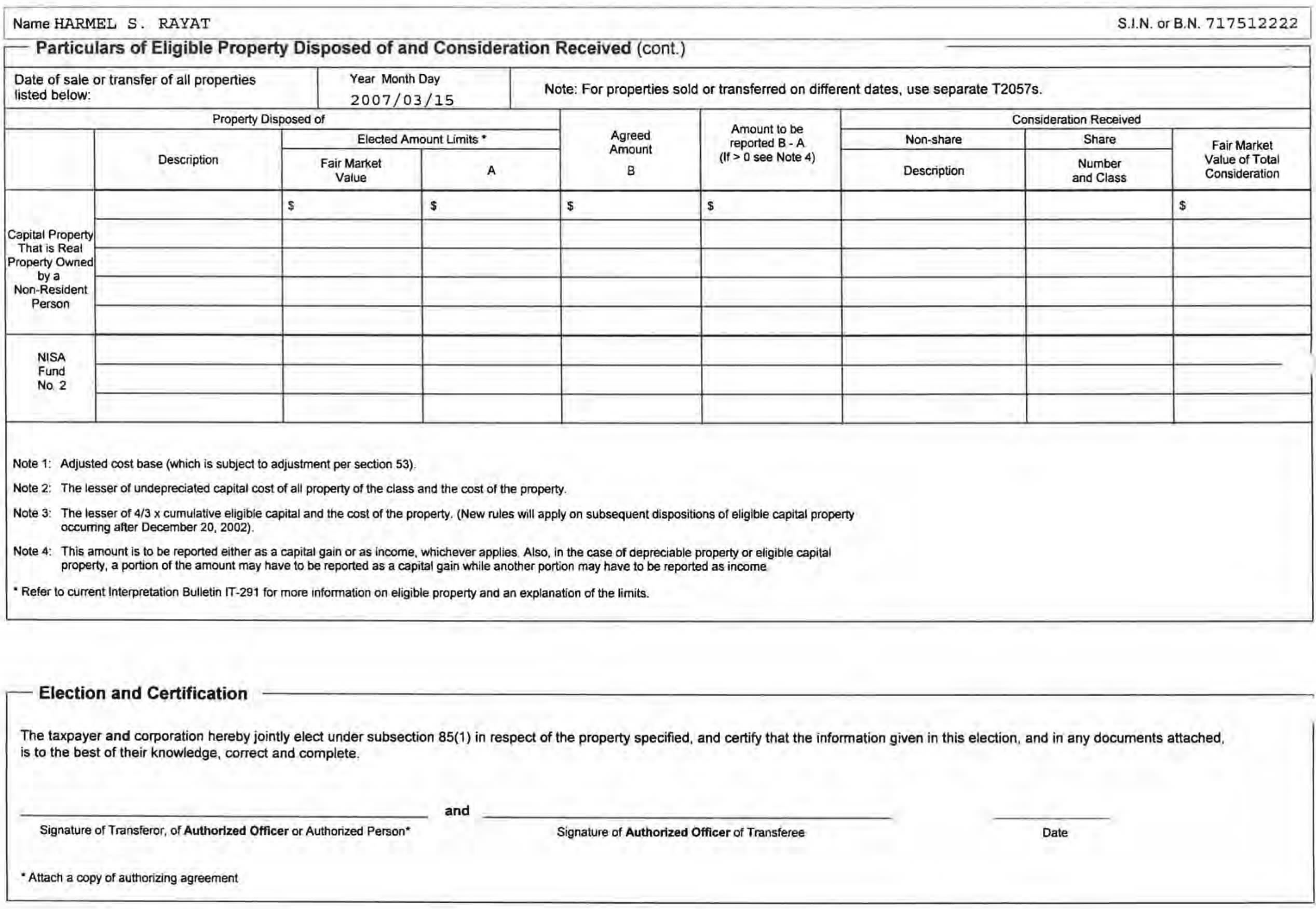

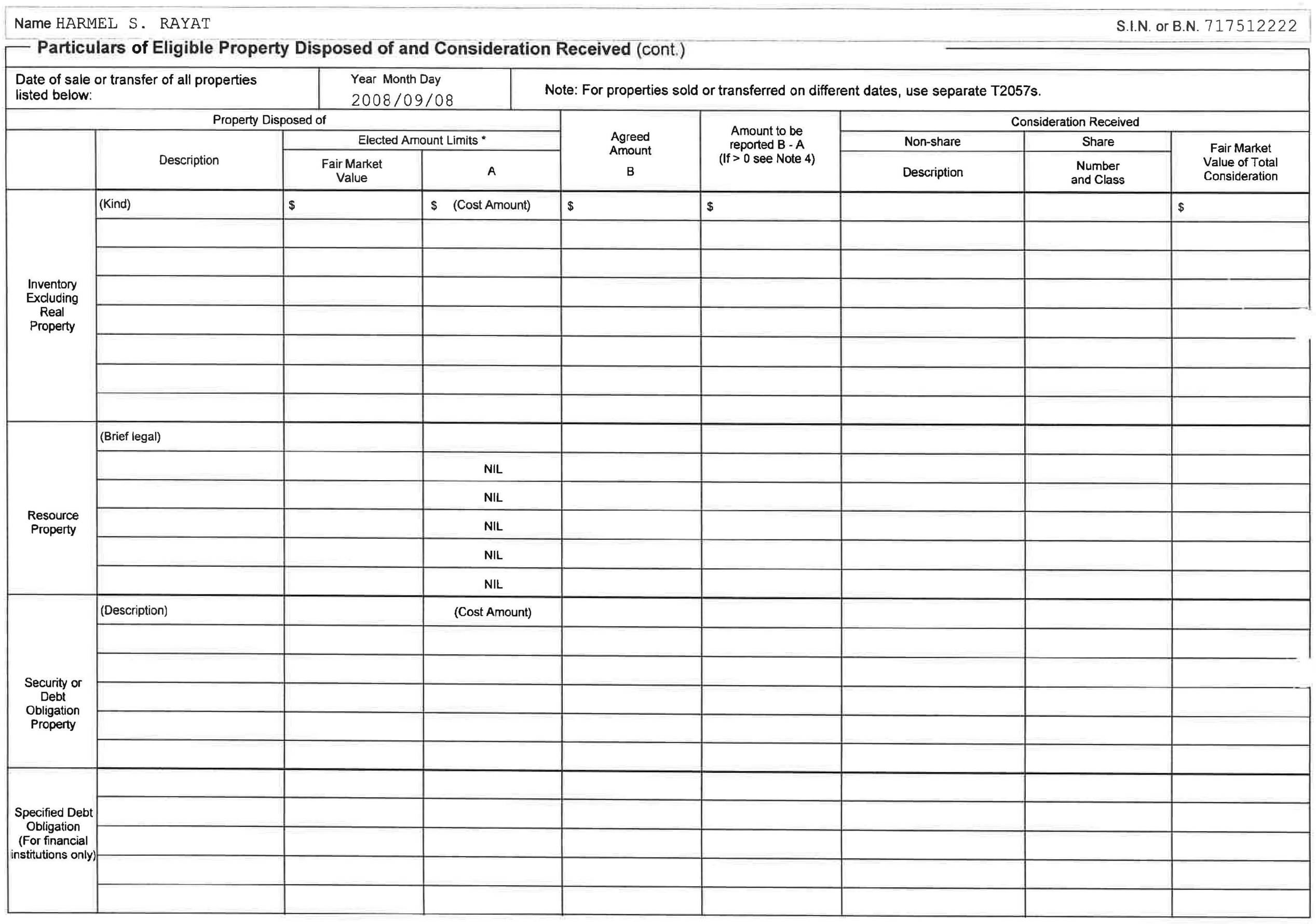

Ms. Ellis has served as the personal accountant to defendants Harmel Rayat and Jeetenderjit Sidhu for over fifteen years. See, e.g., Ex. 1, RCHR-SEC-000011915 (March 28, 2011 email from Ms. Ellis to Mr. Sidhu and Mr. Rayat). As an accountant at Deloitte LLP, Ms. Ellis provided accounting advice and was involved in structuring the Estate Planning Transactions that the SEC now alleges permitted Mr. Rayat to profit indirectly from the StreetAuthority campaign. See, e.g., Ex. 2, RCHR-SEC-000010517 (September 1, 2008 Memorandum from Harmel Rayat to Lloyd Aasen and Mary Ellis regarding “Trust Documents”); Ex. 3, RCHR-SEC-000010522 (Election on Disposition of Property by Harmel Rayat in tax year 2007 regarding Boston Financial Group); Ex. 4, RCHR-SEC-000010533 (Election on Disposition of Property by Harmel Rayat in tax year 2007 regarding Fargo West Investments Ltd.); Ex. 5, RCHR-SEC-000010549 (Election on Disposition of Property by Harmel Rayat in tax year 2007 regarding 1420527 Alberta Ltd.).

Ms. Ellis can provide testimony regarding the purpose of the Estate Planning Transactions, Defendants’ other financial relationships, and other accounting and tax-related issues. See, e.g., Ex. 6, RCHR-SEC-000002953 (February 21, 2011 Letter from Deloitte Associate Partner Randy Munro to Lloyd Asen (Mr. Rayat “intended for the future value of Boston [Financial Group] to accrue to the benefit of the [Bhogal] Legacy Family Trust.... please do not hesitate to contact Mary Ellis”)). Ms. Ellis can provide testimony regarding the structure of the Estate Planning Transactions: including to test Rayat's contention that the transactions were an exchange of fair market value and that was not possible for Mr. Rayat to profit from trading conducted by entities owned by Mr. Bhogal and Mr. Sidhu given the Canadian Income Tax Act provision utilized in the Estate Planning Transactions. See Income Tax Act, RSC 1985, c 1 (5th Supp.), s 85. As Rayat's long-time accountant, she can also testify as to the nature of Rayat's other financial relationships with Bhogal, Sidhu, and Defendant Sharon Fleming. Thus, Ms. Ellis's testimony would be relevant to the SEC's theory that Rayat sought to benefit from the alleged scheme through his financial interests in the other Defendants. Am. Compl. ¶¶ 62-67; 195-97. Ms. Ellis's current employer MNP LLP possesses documents related to the Estate Planning Transactions, Defendants’ other financial relationships, and Defendants’ other accounting and tax-related issues. In addition, given that certain of the Estate Planning Transactions occurred as earlier as 2007, Ms. Ellis's former employer Deloitte LLP possesses documents relevant to this matter. Defendants have made attempts to secure the voluntary production of relevant documents without success.

II. Assistance Requested

The assistance of the British Columbia Supreme Court in Vancouver, British Columbia, Canada, is requested because the evidence sought from Ms. Ellis, MNP LLP, and Deloitte LLP is relevant to discovery in this case, and also necessary for use at trial, and the evidence is not otherwise obtainable by this Court at the trial through this Court's compulsory process. Therefore, this Court respectfully requests that, in the interests of justice, you issue appropriate orders, subpoenas, or other compulsory process necessary to compel Ms. Ellis to attend a sworn oral deposition for three days under Canadian law, or13.5 hours total hours, to permit the numerous parties to conduct their examinations. This Court further requests that the proper judicial authorities of the Province of British Columbia cause the depositions to be transcribed by a qualified court reporter, the transcript of the deposition to be authenticated, and the authenticated records to be delivered to counsel for all parties in this litigation. This Court further requests, in the interests of justice, you issue appropriate orders, subpoenas, or other compulsory process necessary to compel the production of relevant documents from MNP LLP and Deloitte LLP.

*9 The Court requests that the parties be permitted to have the testimony videotaped by a qualified videographer, and that the original transcript of the testimony and the videotapes be returned to the parties for retention and production for trial. This Court further requests that U.S. counsel for the Defendants conduct the examination of the witness, that U.S. counsel for Commission be permitted to cross-examine the witnesses after the Defendant's examination is complete, and that U.S. counsel for the Defendants have an opportunity to conduct further examination, if necessary. Mr. Rayat requests at least 3.5 hours to question Ms. Ellis and anticipates that the Commission and co-Defendants will seek to question Ms. Ellis for a comparable amount of additional time.

Pursuant to 28 U.S.C. § 1782, this Court stands ready to extend similar assistance to the Courts of Canada in like cases.

III. Witnesses and Documents Requested

A. Instructions

1. This request calls for the production of documents in the possession, custody, or control of the witness.

B. Definitions

1. “Document” includes any written, printed, or typed matter including, but not limited to all drafts and copies bearing notations or marks not found in the original, letters and correspondence, interoffice communications, slips, tickets, records, worksheets, financial records, accounting documents, bookkeeping documents, memoranda, reports, manuals, telephone logs, telegrams, facsimiles, messages of any type, telephone messages, voice mails, tape recordings, notices, instructions, minutes, summaries, notes of meetings, file folder markings, and any other organizational indicia, purchase orders, information recorded by photographic process, including microfilm and microfiche, computer printouts, spreadsheets, and other electronically stored information, including but not limited to writings, drawings, graphs, charts, photographs, sound recordings, images, and other data or data compilations that are stored in any medium from which information can be retrieved, obtained, manipulated, or translated.

2. “Person” means a natural person, firm, association, organization, partnership, business, trust, corporation, bank or any other private or public entity.

3. The following rules of construction apply to this attachment:

a. the functional words “any” and “all” shall be deemed to include the other functional word;

b. the connectives “and” and “or” shall be construed either disjunctively or conjunctively as necessary to bring within the scope of the attachment all responses that might otherwise be construed to be outside of its scope;

c. the use of the singular form of any word includes the plural and vice versa; and

d. the term “including” means including, but not limited to.

4. “Communication” means any correspondence, contact, discussion, e-mail, instant message, or any other kind of oral or written exchange or transmission of information (in the form of facts, ideas, inquiries, or otherwise) and any response thereto between two or more Persons or entities, including, without limitation, all telephone conversations, face-to-face meetings or conversations, internal or external discussions, or exchanges of a Document or Documents.

5. “Representative” of a Person means any present or former family members, officers, executives, partners, joint-venturers, directors, trustees, employees, consultants, accountants, attorneys, agents, or any other representative acting or purporting to act on behalf of the Person.

6. “RenovaCare,” means Defendant RenovaCare, Inc., and all predecessors, successors, parents, subsidiaries, affiliates, officers, directors, employees, agents, general partners, limited partners, partnerships and aliases, code names or trade or business names used by any of the foregoing, and all entities in which Defendant RenovaCare Inc. has or has had a controlling interest, such as a corporation, general partnership, limited partnership, or trade or business name, including, but not limited to, Entheos Technologies Inc.

*10 7. “Concerning” means directly or indirectly, in whole or in part, describing, constituting, evidencing, recording, evaluating, substantiating, concerning, referring to, alluding to, in connection with, commenting on, relating to, regarding, discussing, showing, analyzing or reflecting.

C. Witnesses and Documents Requests

1. Mary Ellis

MNP LLP

Suite 620 - 19933 88th Avenue

Langley, BC, V2Y 4K5

The Commission alleges that Mr. Rayat profited from trading in RenovaCare shares through his interest in entities controlled by defendants Jeetenderjit Sidhu and Jatinder Bhogal. Ms. Ellis has served as Mr. Rayat and Mr. Sidhu's accountant for over a decade. Ms. Ellis was also the architect of the Estate Planning Transactions that the Commission alleges are one means by which Mr. Rayat profited from Mr. Sidhu and Mr. Bhogal's securities trading. Ms. Ellis can provide testimony regarding the purpose and structure of the Estate Planning Transactions, defendants’ other financial relationships, and other of defendants’ accounting and tax-related information.

Thus, Ms. Ellis's testimony is critical to the SEC's claims and Mr. Rayat's defense. This Court therefore requests Ms. Ellis's deposition under oath for three days under Canadian law, or13.5 hours total hours, to permit the numerous parties to conduct their examinations.

2. MNP LLP

Suite 620 - 19933 88th Avenue

Langley, BC

V2Y 4K5

Ms. Ellis's current employer, MNP LLP, provides accounting services to defendants Harmel Rayat and Jeetenderjit Sidhu. Accordingly, MNP LLP possesses documents relevant to the Estate Planning Transactions described above, defendants’ other financial relationships, and defendants’ other accounting and tax-related information. This Court therefore requests the production of the following documents from MNP LLP:

a. All documents and communications concerning RenovaCare, Inc., Jatinder Bhogal, Harmel Rayat, Kalen Capital Corporation, Kalen Capital Holdings LLC, 1420524 Alberta Ltd., 1420525 Alberta Ltd., or 1420468 Alberta Ltd., and any of Jeetenderjit Sidhu, 1422688 Alberta Ltd, Fargo West Investments Ltd., Collingwood Holdings LLC, Blackbriar Asset Management Ltd., Blackbriar Asset Management LLC, Treadstone Financial Group Ltd., Treadstone Financial Group LLC, the DS Sidhu Trust, the PK Sidhu Trust, Gurmeet Sidhu, Jasvir S. Kheleh, Amarjit Kaur Sidhu, Anchhattar Singh Sidhu, Manjit Kaur Sidhu, Priya Kaur Sidhu, Jasvir K. Sidhu, or Dayan Singh Sidhu;

b. All documents and communications concerning RenovaCare, Inc., Jeetenderjit Sidhu, Harmel Rayat, Kalen Capital Corporation, Kalen Capital Holdings LLC, 1420524 Alberta Ltd., 1420525 Alberta Ltd., or 1420468 Alberta Ltd., and any of Jatinder Bhogal, 1420527 Alberta Ltd., 1420527 Alberta LLC, Boston Financial Group, Ltd., Boston Financial Group LLC, Wolverhampton Holdings LLC, Vector Asset Management Inc., the Heritage Family Trust, the Legacy Family Trust, Amritpal Tanda, Arian Soheili, Nirmal Singh Bhogal, Gurdyal Kaur Bhogal, Kesar Dhaliwal, Indy Panchi, Mehar Bhogal, Mehtab Bhogal, or Ranjit K. Bhogal;

c. All documents and communications concerning the TJR Family Trust, KJR Family Trust, the TJR Investment Trust, the KJR Investment Trust, the Heritage Family Trust, the Legacy Family Trust, the DS Sidhu Trust, and the PK Sidhu Trust, including but not limited to the original trust indenture and any modifications thereto, documents concerning the current existence of these entities, any direct or indirect asset transfers, and any documents or communications relating to the wind-down of these entities;

*11 d. All documents and communications from January 2007 to the present concerning any transaction involving Harmel Rayat, Kalen Capital Corporation, Kalen Capital Holding LLC, 1420524 Alberta Ltd., 1420525 Alberta Ltd., or 1420468 Alberta Ltd. pursuant to Section 85 of the Canadian Income Tax Act and entities directly or indirectly owned, controlled, or associated with Jeetenderjit Sidhu or Jatinder Bhogal, including but not limited to:

i. Documents and communications concerning transactions on or around March 15, 2007 through which Harmel Rayat or Kalen Capital Corporation sold certain common shares in exchange for preferred shares in entities owned and controlled by Jatinder Bhogal, Ranjit Bhogal, Gurmeet Sidhu, or Jeetenderjit Sidhu;

ii. Documents and communications concerning transactions on or around December 31, 2007 through which Harmel Rayat or Kalen Capital Corporation sold certain common shares in exchange for preferred shares in entities owned and controlled by Jatinder Bhogal, Ranjit Bhogal, Gurmeet Sidhu, or Jeetenderjit Sidhu;

iii. Documents and communications concerning transactions between Harmel Rayat or Kalen Capital Corporation and entities associated with Jeetenderjit Sidhu, Gurmeet Sidhu, Ranjit Bhogal, or Jatinder Bhogal on or around September 8, 2008;

iv. Documents and communications concerning any redemption, retraction, or other transfer or disposition of any equity interest, including without limitation preferred or preference shares, in connection with the transactions described in (i)-(iii), including but not limited to a redemption by Boston Financial Group on or around July 8, 2010, a redemption by Fargo West Investments Ltd. on or around March 11, 2011, and a redemption by 1422688 Alberta Ltd. on or around February 22, 2011;

v. Documents and communications concerning any transactions related to the transactions described in (i) - (iv), including but not limited to a “re- freeze,” corporate resolutions related to share redemptions, or corporate reorganization under Section 85 of the Canadian Income Tax Act;

vi. Documents and communications of transactions as described in (i) through (iv) above between Jeetenderjit Singh Sidhu, Gurmeet Sidhu, Ranjit Bhogal, or Jatinder Bhogal or any entity they owned, controlled, or were associated with.

e. All tax returns, financial statements, and related documents for Harmel Rayat, Jatinder Bhogal, and Jeetenderjit Singh Sidhu, or any entity they directly or indirectly owned or controlled (including but not limited to the entities enumerated above), for tax years 2007 to the present, including but not limited to:

i. Canadian Revenue Agency (“CRA”) forms T1, T2, T4, T5, T2054, and T2057;

ii. Any interactions with the CRA, including notices of assessment, reassessment, or any tax disputes; or

iii. Documents related to any reorganization pursuant to Sections 51, 85, 86, or 87 of the Canadian Tax Act.

f. All tax returns, financial statements, and related documents for the TJR Family Trust, KJR Family Trust, TJR Investment Trust, KJR Investment Trust, the Heritage Family Trust, the Legacy Family Trust, the DS Sidhu Family Trust, and the PK Sidhu Family Trust for tax years 2007 to present, including but not limited to:

i. CRA form T3;

ii. Any interactions with the CRA, including notices of assessment, reassessment, or any tax disputes; or

iii. All documentation related to the creation or dissolution of the foregoing.

g. All communications with Harmel Rayat, Jatinder Bhogal, Jeetenderjit Singh Sidhu, Gurmeet Sidhu, or Ranjit Bhogal, or anyone acting on their behalf, including but not limited to Lloyd Aasen,, subject to a review for any applicable legal privilege.

3. Deloitte LLP

*12 939 Granville St.

Vancouver, BC

V6Z 1L3

Ms. Ellis's former employer, Deloitte LLP, provided accounting services to defendants Harmel Rayat and Jeetenderjit Sidhu at the time they entered into the Estate Planning Transactions. Accordingly, Deloitte LLP possesses documents relevant to the Estate Planning Transactions described above, defendants’ other financial relationships, and other of defendants’ accounting and tax-related information. This Court therefore requests the production of the following documents from MNP LLP:

a. All documents and communications concerning RenovaCare, Inc., Jatinder Bhogal, Harmel Rayat, Kalen Capital Corporation, Kalen Capital Holdings LLC, 1420524 Alberta Ltd., 1420525 Alberta Ltd., or 1420468 Alberta Ltd., and any of Jeetenderjit Sidhu, 1422688 Alberta Ltd, Fargo West Investments Ltd., Collingwood Holdings LLC, Blackbriar Asset Management Ltd., Blackbriar Asset Management LLC, Treadstone Financial Group Ltd., Treadstone Financial Group LLC, the DS Sidhu Trust, the PK Sidhu Trust, Gurmeet Sidhu, Jasvir S. Kheleh, Amarjit Kaur Sidhu, Anchhattar Singh Sidhu, Manjit Kaur Sidhu, Priya Kaur Sidhu, Jasvir K. Sidhu, or Dayan Singh Sidhu;

b. All documents and communications concerning RenovaCare, Inc., Jeetenderjit Sidhu, Harmel Rayat, Kalen Capital Corporation, Kalen Capital Holdings LLC, 1420524 Alberta Ltd., 1420525 Alberta Ltd., or 1420468 Alberta Ltd., and any of Jatinder Bhogal, 1420527 Alberta Ltd., 1420527 Alberta LLC, Boston Financial Group, Ltd., Boston Financial Group LLC, Wolverhampton Holdings LLC, Vector Asset Management Inc., the Heritage Family Trust, the Legacy Family Trust, Amritpal Tanda, Arian Soheili, Nirmal Singh Bhogal, Gurdyal Kaur Bhogal, Kesar Dhaliwal, Indy Panchi, Mehar Bhogal, Mehtab Bhogal, or Ranjit K. Bhogal;

c. All documents and communications concerning the TJR Family Trust, KJR Family Trust, the TJR Investment Trust, the KJR Investment Trust, the Heritage Family Trust, the Legacy Family Trust, the DS Sidhu Trust, and the PK Sidhu Trust, including but not limited to the original trust indenture and any modifications thereto, documents concerning the current existence of these entities, any direct or indirect asset transfers, and any documents or communications relating to the wind-down of these entities;

d. All documents and communications from January 2007 to the present concerning any transaction involving Harmel Rayat, Kalen Capital Corporation, Kalen Capital Holdings LLC, 1420524 Alberta Ltd., 1420525 Alberta Ltd., or 1420468 Alberta Ltd. pursuant to Section 85 of the Canadian Income Tax Act and entities directly or indirectly owned, controlled, or associated with Jeetenderjit Sidhu or Jatinder Bhogal, including but not limited to:

i. Documents and communications concerning transactions on or around March 15, 2007 through which Harmel Rayat or Kalen Capital Corporation sold certain common shares in exchange for preferred shares in entities owned and controlled by Jatinder Bhogal, Ranjit Bhogal, Gurmeet Sidhu, or Jeetenderjit Sidhu;

*13 ii. Documents and communications concerning transactions on or around December 31, 2007 through which Harmel Rayat or Kalen Capital Corporation sold certain common shares in exchange for preferred shares in entities owned and controlled by Jatinder Bhogal, Ranjit Bhogal, Gurmeet Sidhu, or Jeetenderjit Sidhu;

iii. Documents and communications concerning transactions between Harmel Rayat or Kalen Capital Corporation and entities associated with Jeetenderjit Sidhu, Gurmeet Sidhu, Ranjit Bhogal, or Jatinder Bhogal on or around September 8, 2008;

iv. Documents and communications concerning any redemption, retraction, or other transfer or disposition of any equity interest, including without limitation preferred or preference shares, in connection with the transactions described in (i)-(iii), including but not limited to a redemption by Boston Financial Group on or around July 8, 2010, a redemption by Fargo West Investments Ltd. on or around March 11, 2011, and a redemption by 1422688 Alberta Ltd. on or around February 22, 2011;

v. Documents and communications concerning any transactions related to the transactions described in (i) - (iv), including but not limited to a “re- freeze,” corporate resolutions related to share redemptions, or corporate reorganization under Section 85 of the Canadian Income Tax Act;

vi. Documents and communications of transactions as described in (i) through (iv) above between Jeetenderjit Singh Sidhu, Gurmeet Sidhu, Ranjit Bhogal, or Jatinder Bhogal or any entity they owned, controlled, or were associated with.

e. All tax returns, financial statements, and related documents for Harmel Rayat, Jatinder Bhogal, and Jeetenderjit Singh Sidhu, or any entity they directly or indirectly owned or controlled (including but not limited to the entities enumerated above), for tax years 2007 to the present, including but not limited to:

i. Canadian Revenue Agency (“CRA”) forms T1, T2, T4, T5, T2054, and T2057;

ii. Any interactions with the CRA, including notices of assessment, reassessment, or any tax disputes; or

iii. Documents related to any reorganization pursuant to Sections 51, 85, 86, or 87 of the Canadian Tax Act.

f. All tax returns, financial statements, and related documents for the TJR Family Trust, KJR Family Trust, TJR Investment Trust, KJR Investment Trust, the Heritage Family Trust, the Legacy Family Trust, the DS Sidhu Family Trust, and the PK Sidhu Family Trust for tax years 2007 to present, including but not limited to:

i. CRA form T3;

ii. Any interactions with the CRA, including notices of assessment, reassessment, or any tax disputes; or

iii. All documents related to the creation or dissolution of the foregoing.

g. All communications with Harmel Rayat, Jatinder Bhogal, Jeetenderjit Singh Sidhu, Gurmeet Sidhu, or Ranjit Bhogal, or anyone acting on their behalf, including but not limited to Lloyd Aasen, and subject to a review for any applicable legal privilege.

The Honorable Lewis J. Liman

UNITED STATES DISTRICT JUDGE

Exhibit A

JURY TRIAL DEMANDED

COMPLAINT

Plaintiff Securities and Exchange Commission (the “Commission”), for its Complaint against Defendants Harmel S. Rayat (“Rayat”) and RenovaCare, Inc. (“RenovaCare” or “company”), alleges as follows:

SUMMARY OF ALLEGATIONS

1. From at least July 2017 until January 2018, RenovaCare and Rayat, the company's controlling shareholder, defrauded investors by soliciting StreetAuthority, LLC (“StreetAuthority”), an online financial publishing company, to run a promotion designed to increase RenovaCare's stock price and trading volume, and then concealed their involvement in the promotion from investors. Rayat worked closely with StreetAuthority on the promotion. He provided false information to StreetAuthority regarding the efficacy of RenovaCare's experimental burn-wound healing medical device called the “SkinGun,” edited StreetAuthority's promotional materials, advised StreetAuthority on how to distribute the promotion to enhance its effectiveness, and arranged to pay StreetAuthority for the promotion using RenovaCare's funds that were routed through third parties.

*14 2. By January 2018, OTC Markets Group Inc. – the entity that supervised the market where RenovaCare's stock was quoted – learned of StreetAuthority's RenovaCare promotion and sent RenovaCare a letter demanding that the company make public disclosures concerning its involvement in the promotion. On January 8, 2018, rather than acknowledging Rayat's and the company's involvement in the StreetAuthority promotion, Rayat and RenovaCare made and publicly disseminated a press release that contained material misrepresentations and omissions that denied any involvement in StreetAuthority's promotion.

3. By engaging in the conduct described in this Complaint, Rayat and RenovaCare violated Section 10(b) of the Securities Exchange Act of 1934 (“Exchange Act”), 15 U.S.C. § 78j(b), and Rule 10b-5 thereunder, 17 C.F.R. § 240.10b-5, and RenovaCare violated Section 15(d) of the Exchange Act, 15 U.S.C. § 78o(d), and Rules 15d-11 and 12b-20 thereunder, 17 C.F.R §§ 240.15d-1 & 240.12b-20. Rayat also aided and abetted RenovaCare's deceptive acts and false statements pursuant to Section 20(e) of the Exchange Act, 15 U.S.C. § 78t(e). Unless restrained and enjoined, Defendants will engage in further violations of these provisions.

4. The Commission respectfully requests, among other things, that the Court enjoin Defendants from committing further violations of the Federal securities laws as alleged in this Complaint, order Defendants to pay civil monetary penalties, bar Rayat from participating in any offering of a penny stock and serving as an officer or director of a public company, and order other appropriate and necessary equitable relief.

JURISDICTION AND VENUE

5. This Court has jurisdiction over this action pursuant to Sections 21(d), 21(e), and 27(a) of the Exchange Act, 15 U.S.C. §§ 78u(d)-(e) & 78aa(a).

6. Venue is proper in this District pursuant to Section 27 of the Exchange Act, 15 U.S.C. § 78aa, and 28 U.S.C. § 1391(c)(3). During the time period alleged in this Complaint, RenovaCare was headquartered and transacted business in this District, and its shares traded on the OTCQB Tier, the interdealer quotation system operated by OTC Markets Group, Inc. (“OTC Markets”), which was headquartered in this District. In addition, certain of the transactions, acts, practices, and courses of conduct constituting the violations alleged in this Complaint occurred within this District. Among other things, Rayat participated in telephone calls and email exchanges with RenovaCare representatives located in this District concerning the drafting and issuing of the false press release, and RenovaCare sent the deceptive payments to its third-party investor relations consultants for the StreetAuthority promotion through an account with a bank located in this District. Rayat also conducts substantial business in the United States and owns several commercial properties in Arizona for investment purposes.

7. Rayat is a Canadian citizen who engaged in fraudulent conduct in the United States and in Canada that had a foreseeable and substantial effect upon United States investors and the OTC market. In connection with the violations alleged in this case, Rayat traveled to the United States on at least two occasions as an agent for RenovaCare to discuss StreetAuthority's promotion of RenovaCare. He had frequent contact with StreetAuthority and RenovaCare employees and consultants in the United States, including in this District, over the phone, email, and other interstate means in furtherance of StreetAuthority's promotion of RenovaCare and to draft and issue the company's false press release that is the subject of this Complaint. When reviewing, approving, and transmitting the false press release to RenovaCare's CEO for dissemination to the public, Rayat frequently communicated over the telephone and email with at least one RenovaCare representative who was located in this District. Rayat also knew that the false press release was prepared in response to an inquiry from OTC Markets, which was based in this District, and would be disseminated to investors throughout the United States, including in this District.

*15 8. Defendants have, directly and indirectly, made use of the means or instrumentalities of interstate commerce and/or of the mails, including the use of email, telephone, and the internet in connection with illegal acts alleged in this Complaint, certain of which occurred within this District.

DEFENDANTS

9. Harmel S. Rayat, (“Rayat”) age 59, is a Canadian citizen and resident of Vancouver, British Columbia. Through his wholly owned holding company Kalen Capital Corporation (“Kalen”), Rayat has been the majority and controlling shareholder of RenovaCare, Inc. since at least 1999. As of January 1, 2021, Rayat owned 71,101,453 million shares of common stock, or 81.3 percent of the company's outstanding shares of common stock. Rayat has also served as RenovaCare's Chairman of the Board of Directors.

10. RenovaCare, Inc. (“RenovaCare” or “company”) is a Nevada corporation that is currently headquartered in Roseland, New Jersey. During the time period at issue in this Complaint, RenovaCare was headquartered at 430 Park Avenue, New York, New York. RenovaCare is a development stage company with no revenues, but claims to be developing a “SkinGun” medical device and “CellMist” system for the treatment of skin burns through the rapid regeneration of skin cells.

11. RenovaCare had securities registered with the Commission pursuant to Exchange Act Section 12(g) until August 3, 2016, when it filed a Form 15 to terminate the registration. RenovaCare is currently quoted on the OTC Pink Open Market Tier, operated by OTC Markets under the ticker symbol “RCAR.” During the time period relevant to this Complaint, the company's stock constituted a penny stock because it did not meet any of the exceptions from the definition of a “penny stock” pursuant to Exchange Act Section 3(a)(51), 15 U.S.C. § 78c(a)(51), and Exchange Act Rule 3a51-1, 17 C.F.R. § 240.3a51-1.

12. RenovaCare was originally incorporated in Utah on July 14, 1983, as “Far West Gold, Inc.” On May 20, 1999, the company changed its name to “WhatsOnline.Com, Inc.,” and Rayat became, and ever since has been, the company's majority and controlling shareholder. The company later made several other name changes, until January 7, 2014, when it changed its name to RenovaCare.

OTHER RELEVANT ENTITIES

13. StreetAuthority, LLC, (“StreetAuthority”), was an online financial publishing and research company based in Austin, Texas, that sold subscriptions to its investment research bulletins and newsletters during the time period at issue in this Complaint. It was owned and operated by a long-time friend of Rayat (“StreetAuthority Owner”).

14. Company A is a company whose stock is quoted on the OTC Markets that purports to be developing and marketing windows for residential and commercial buildings that generate electricity from solar energy. During the time period at issue in this case, Rayat was a controlling shareholder of Company A.

FACTS

I. Rayat And RenovaCare Solicited StreetAuthority To Run A Promotional Campaign To Increase The Price And Trading Volume Of RenovaCare's Stock And Then Concealed Their Involvement In It

15. By July 2017, Rayat owned approximately 65 percent of RenovaCare's stock (approximately 52 million shares), and was the company's controlling shareholder. At that time, Rayat, on behalf of RenovaCare, solicited StreetAuthority, an online financial publisher of investment newsletters with a dedicated subscriber base, to run a promotional campaign for RenovaCare and Company A, another company in which Rayat was the controlling shareholder. Rayat was interested in the promotion because he wanted to increase RenovaCare's stock price and trading volume, which would benefit him and his close associates who owned the company's stock.

*16 16. From the outset, Rayat worked closely with StreetAuthority on the campaign. Among other things, Rayat, on behalf of RenovaCare, reviewed StreetAuthority's promotional materials, and provided StreetAuthority with information on the company, including false information regarding the efficacy of the “SkinGun,” the company's experimental medical device for treating burn wounds.

17. Rayat also arranged for RenovaCare to pay StreetAuthority $50,000 per month for the promotion, and arranged for the payment to be made through third parties for the fraudulent purpose of concealing Rayat's and the company's involvement.

A. Rayat Solicited StreetAuthority To Promote RenovaCare's Stock

18. Rayat was a long-time friend of the StreetAuthority Owner. While he was RenovaCare's controlling shareholder, on or about July 26, 2017, Rayat solicited the StreetAuthority Owner to start a promotional campaign for RenovaCare and Company A. That day, Rayat spoke to the StreetAuthority Owner on the phone, and later emailed marketing materials related to RenovaCare's SkinGun to the StreetAuthority Owner.

19. On July 28, 2017, the StreetAuthority Owner suggested to Rayat that StreetAuthority feature RenovaCare and Company A in its annual “Predictions Report.” The StreetAuthority Owner noted that this could “create awareness of both companies” and persuade StreetAuthority subscribers to invest in RenovaCare and Company A. The StreetAuthority Owner further stated that StreetAuthority was interested in “partnering up” with Rayat to advertise on various online media platforms. In response, Rayat agreed it was a “great idea,” and then arranged to discuss the proposal in more detail.

20. Between July 28 and August 31, 2017, Rayat discussed the details of the promotion with StreetAuthority representatives on several occasions, including an in-person meeting at StreetAuthority's headquarters in Austin, Texas, in late August, 2017.

21. On September 4, 2017, shortly after Rayat's trip to Austin, the StreetAuthority Owner emailed Rayat to discuss several different marketing strategies in which StreetAuthority could promote RenovaCare and Company A, and asked if Rayat was “interested in exploring and participating in this marketing program.”

22. Later that day, Rayat responded that “nothing would make me happier than working with [the StreetAuthority Owner and other StreetAuthority representatives] in spreading the word to investors and dramatically improving [RenovaCare's and Company A's] awareness in the investment community, which I wholeheartedly believe will help the companies raise additional capital and get senior listings, which in turn will allow institutional investors to jump in.” Rayat further noted that he was “very interested in exploring how [they could] work together,” and suggested they speak the next day.

23. The discussions between Rayat and StreetAuthority about the creation of a RenovaCare and Company A promotion continued into October 2017.

B. Rayat Concealed His And The Company's Involvement In The Promotion By Arranging For RenovaCare's Payments To StreetAuthority To Be Paid Through Third Parties

24. Before StreetAuthority launched its promotion of RenovaCare and Company A, the StreetAuthority Owner and Rayat orally agreed that StreetAuthority would receive a $100,000 per month for the promotion that would be split between the two companies. StreetAuthority agreed to use that money to pay for advertising and other distribution costs relating to the publication and dissemination of its promotion of RenovaCare and Company A.

*17 25. Rather than have RenovaCare and Company A pay StreetAuthority directly, Rayat arranged for the companies to pay StreetAuthority through a third-party investor relations company that Rayat had hired in the past for other promotional campaigns (“Investor Relations Company A”). Rayat arranged for RenovaCare to pay Investor Relations Company A $2,500 per month, and the only service Investor Relations Company A provided in exchange for this money was to prepare invoices and route payments between RenovaCare and StreetAuthority. Rayat provided the same arrangement as to Company A.

26. Rayat devised this deceptive payment scheme on behalf of RenovaCare to conceal from the investing public that RenovaCare was, in fact, paying StreetAuthority for the promotion. Rayat knew, or was reckless in not knowing, that StreetAuthority would have to disclose in its promotional materials any payments RenovaCare made to StreetAuthority pursuant to Section 17(b) of the Securities Act of 1933 (“Securities Act”), 15 U.S.C. § 77q(b). In 2000, Rayat had settled a case with the Commission in which he was charged with violating Section 17(b) of the Securities Act. SEC v. EquityAlert.Com, Inc. and Harmel S. Rayat, No. cv-00-146 (D. Ariz. Aug. 24, 2000).

27. For example, the disclosures in StreetAuthority's RenovaCare and Company A promotional materials pursuant to Securities Act Section 17(b) stated that StreetAuthority did “not receive any direct cash payments in connection with the production of paid advertisements” for Company A and RenovaCare. Rayat, however, arranged for the investor relations company, not RenovaCare, to make the direct payments to StreetAuthority. Rayat's payment arrangement – that concealed the company's and its controlling shareholder's involvement in and potential financial incentives to StreetAuthority in promoting the stock – had the effect of reducing investor skepticism regarding the truthfulness of the campaign by making it appear to investors that StreetAuthority was offering an objective and fair assessment of RenovaCare's stock.

28. Throughout StreetAuthority's campaign, RenovaCare and Company A funneled money through Investor Relations Company A to Street Authority, until another investor relations company that Rayat selected (“Investor Relations Company B”), replaced Investor Relations Company A on or around January 4, 2018.

29. RenovaCare's CEO approved all of the payments from RenovaCare to Investor Relations Company A and Investor Relations Company B, while he knew, or was reckless in not knowing, that they were ultimately going to StreetAuthority for the promotion. On November 9, 2017, for example, RenovaCare's CEO approved the company to pay $46,000 to Investor Relations Company A based on invoices Investor Relations Company A sent RenovaCare's CEO charging the company $43,500 for the StreetAuthority promotion and $2,500 for Investor Relations Company A's monthly retainer.

30. In all, by January 4, 2018, RenovaCare paid approximately $90,000 to StreetAuthority through these two investor relations companies.

C. Rayat Worked Closely With StreetAuthority To Create And Disseminate A Promotion Of RenovaCare

31. By at least September 2017, StreetAuthority began drafting materials for its RenovaCare and Company A promotion, and it publicly released the promotion on or about October 24, 2017. StreetAuthority disseminated the promotional materials in emails to its subscriber base, as well as on the internet more broadly in banners advertisements on internet search engines, social media sites, and other internet platforms. A key piece of the promotion were certain periodic reports such as an annual “Predictions Report” for the next calendar year, of which the success of RenovaCare's and Company A's products were StreetAuthority's lead “predictions.”

*18 32. Rayat actively worked with StreetAuthority to create StreetAuthority's promotional materials, including the Predictions Report. He regularly provided information to StreetAuthority to use for its promotion, and he reviewed and commented on draft promotional materials prior to their release.

33. StreetAuthority's promotional materials highly touted RenovaCare. For example, the promotional materials claimed that the SkinGun was a “revolutionary wound-healing device,” and encouraged readers to buy RenovaCare stock and hold it for “10, 20x, even 40x gains.”

34. In describing the basis for its recommendation, StreetAuthority's promotional materials described a case study of one patient who had severe burns on his arm (“Patient A”) that the SkinGun purportedly healed in three days. The promotional materials further showed the following purported “before” and “after” SkinGun-treatment pictures of Patient A:

35. However, the SkinGun did not heal Patient A's wounds in three days; after treatment, Patient A's skin remained discolored for over a year. Furthermore, the “before” photo was not Patient A's arm, and the “after” picture was taken approximately five years after Patient A's injury, not three days.

36. Rayat provided materials containing these false pictures and claims about Patient A's SkinGun treatment to StreetAuthority. On July 26, 2017, Rayat emailed RenovaCare marketing materials to StreetAuthority that contained Patient A's false before-and-after pictures, and on September 21, 2017, Rayat emailed StreetAuthority additional marketing materials that contained the false claim that the SkinGun healed Patient A's arm in three days.

37. When sending these materials to StreetAuthority, Rayat knew, or was reckless in not knowing, that the materials contained false information and would be disseminated to investors. RenovaCare employees had discussed the actual results of Patient A's treatment with Rayat, and sent Rayat an accurate summary of his treatment, as early as July 23, 2014. The summary Rayat received that day explained that Patient A's arm took months to heal, and it contained accurate pictures illustrating the treatment, and not the pictures of Patient A that Rayat later sent to StreetAuthority.

38. StreetAuthority's promotional materials also claimed that the SkinGun “could soon be approved by the FDA [Food and Drug Administration].... RenovaCare has submitted a 510(k) filing to the FDA, which permits the marketing of a medical device. Now it's just a matter of waiting on the FDA ... so this device can be rolled out at every burn unit in the country.”

39. However, RenovaCare did not have a pending 510(k) filing with the FDA at the time; in fact, it had only applied to the FDA for approval to use in clinical studies, not in general clinic or hospital settings, and RenovaCare had withdrawn that application more than a year earlier.

40. Prior to their release to the investing public, Rayat reviewed draft promotional materials that contained both of these false claims, but did nothing to correct them. On October 3, 2017, the StreetAuthority Owner emailed Rayat a draft Predictions Report that contained the false statements and pictures concerning Patient A's SkinGun treatment and the SkinGun's status with the FDA. After reviewing the draft, Rayat called the StreetAuthority Owner to suggest at least one change concerning the possibility of the FDA's approval of the SkinGun, but he did not suggest that StreetAuthority correct the false statements in the draft. StreetAuthority subsequently made Rayat's suggested change to its promotional materials.

*19 41. In addition, internal StreetAuthority documents reflect three versions of draft StreetAuthority promotions of RenovaCare and Company A dated October 10, 2017, that are entitled “Harmel changes,” including one draft that contained an internal comment from a StreetAuthority representative indicating that he was deleting certain language in the draft because the deleted language contained something that “Har[m]el doesn't want us to talk about.”

42. When reviewing the draft promotional materials concerning RenovaCare, Rayat knew, or was reckless in not knowing, that the statements about the FDA approval were false. Shortly before that time, in an email between Rayat and an acquaintance on April 14, 2017, Rayat discussed RenovaCare's regulatory strategy, and Rayat explained that RenovaCare did not have a pending 510(k) application.

43. From October 2017 until at least January 2018, StreetAuthority actively disseminated its RenovaCare promotional materials on the internet and to its subscriber base.

44. Throughout this time, Rayat continued to be involved in the drafting of StreetAuthority's promotional materials, and he was closely involved in its distribution and dissemination. For example:

a. At an in-person meeting at StreetAuthority's headquarters in Austin, Texas, on or around November 27, 2017, Rayat and several StreetAuthority representatives reviewed StreetAuthority's distribution and dissemination of the promotional materials. The StreetAuthority representatives discussed the various advertisements they were running with Rayat, and Rayat gave directions to StreetAuthority on how it could more effectively run the campaign. Rayat also provided additional edits to StreetAuthority's promotional materials. After the meeting, StreetAuthority implemented at least some of Rayat's directions.

b. On or around December 3, 2017, Rayat sent StreetAuthority new advertisements that he wanted StreetAuthority to disseminate, and StreetAuthority representatives incorporated those advertisements into the promotional campaign.

c. On or around December 15, 2017, Rayat approved a change in StreetAuthority's format for how StreetAuthority advertised its promotion on one online platform.

D. StreetAuthority's Promotion Of RenovaCare Was Successful

45. The promotional campaign that Rayat solicited, concealed the payments for, and worked closely with StreetAuthority to create and distribute was a success. During the course of the promotional campaign, internet users clicked on tens of thousands of RenovaCare ads created by StreetAuthority. For instance, one of the several online platforms StreetAuthority used to promote RenovaCare alone generated over 20,000 clicks from internet users.

46. RenovaCare stock saw an uptick in volume and price that correlated with StreetAuthority's promotional campaign. On October 23, 2017, RenovaCare's stock price closed at $3.10 per share, and by January 5, 2018, it had risen to $4.91 per share, an approximately 58 percent increase.

II. In Response To A Regulatory Inquiry, RenovaCare And Rayat Made And Issued A Materially False Press Release Denying Their Involvement In StreetAuthority's Promotional Campaign

A. On January 3, 2018, OTC Markets Demanded RenovaCare Make Disclosures Concerning StreetAuthority's Promotion

47. On or around January 2, 2018, OTC Markets, which supervised the OTCQB Tier in which RenovaCare's stock was quoted, learned of StreetAuthority's promotion.